Just a few months ago, Jazmine Boykins was posting her artwork online for free. The 20-year-old digital artist’s dreamy animations of Black life were drawing plenty of likes, comments and shares, but not much income, aside from money she made selling swag with her designs between classes at North Carolina A&T State University.

But Boykins has recently been selling the same pieces for thousands of dollars each, thanks to an emerging technology upending the rules of digital ownership: NFTs, or non-fungible tokens. NFTs—digital tokens tied to assets that can be bought, sold and traded—are enabling artists like Boykins to profit from their work more easily than ever. “At first, I didn’t know if it was trustworthy or legit,” says Boykins, who goes by the online handle “BLACKSNEAKERS” and who has sold more than $60,000 in NFT art over the past six months. “But to see digital art being bought at these prices, it’s pretty astounding. It’s given me the courage to keep going.”

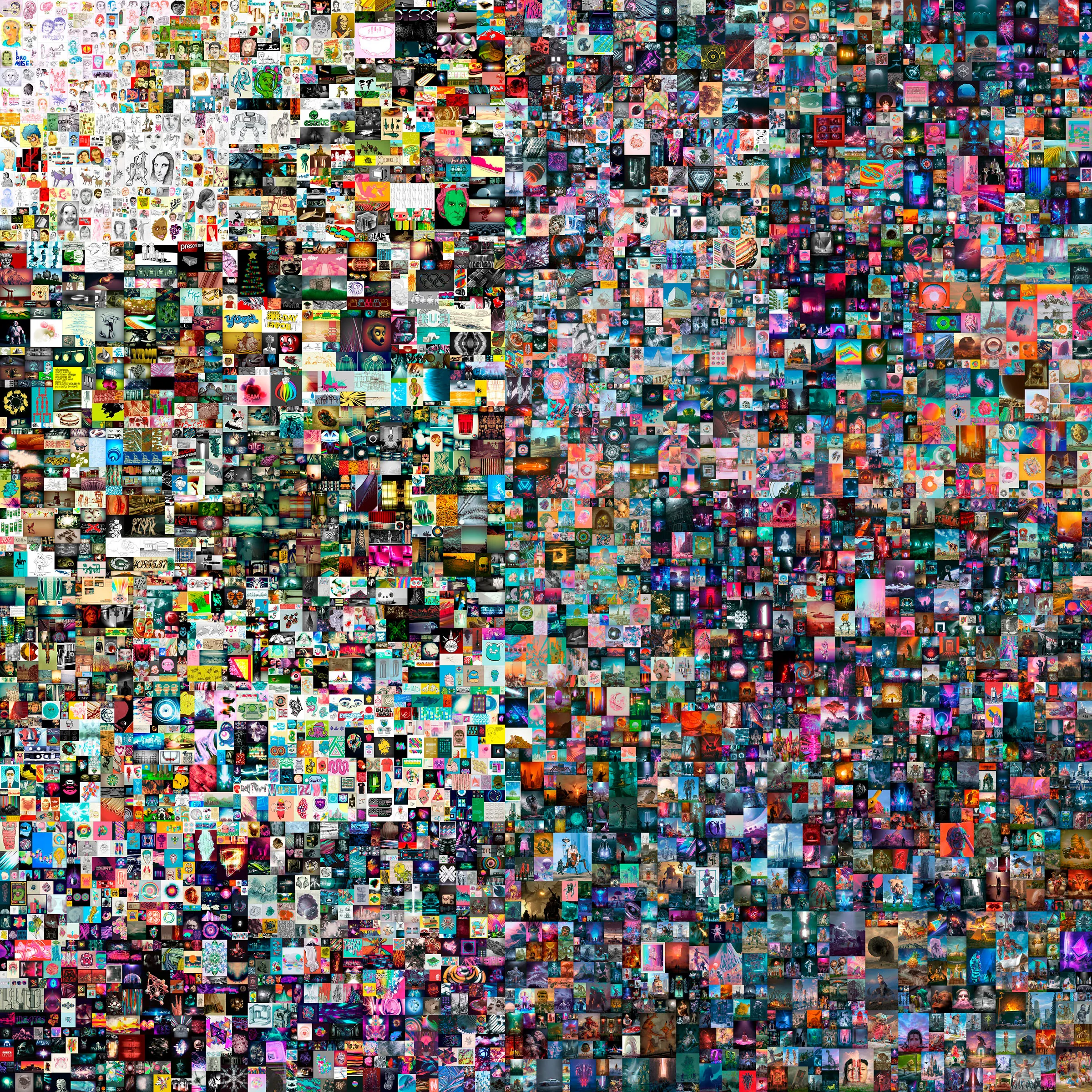

NFTs are having their big-bang moment: collectors and speculators have spent more than $200 million on an array of NFT-based artwork, memes and GIFs in the past month alone, according to market tracker NonFungible.com, compared with $250 million throughout all of 2020. And that was before the digital artist Mike Winkelmann, known as Beeple, sold a piece for a record-setting $69 million at famed auction house Christie’s on March 11—the third highest price ever fetched by any currently living artist, after Jeff Koons and David Hockney.

TIME is now accepting cryptocurrency for subscriptions to time.com. Learn more.

NFTs are best understood as computer files combined with proof of ownership and authenticity, like a deed. Like cryptocurrencies such as Bitcoin, they exist on a blockchain—a tamper-resistant digital public ledger. But like dollars, cryptocurrencies are “fungible,” meaning one bitcoin is always worth the same as any other bitcoin. By contrast, NFTs have unique valuations set by the highest bidder, just like a Rembrandt or a Picasso. Artists who want to sell their work as NFTs have to sign up with a marketplace, then “mint” digital tokens by uploading and validating their information on a blockchain (typically the Ethereum blockchain, a rival platform to Bitcoin). Doing so usually costs anywhere from $40 to $200. They can then list their piece for auction on an NFT marketplace, similar to eBay.

At face value, the whole enterprise seems absurd: big-money collectors paying six to eight figures for works that can often be seen and shared online for free. Critics have dismissed the NFT art craze as just the latest bubble, akin to this year’s boom-and-bust mania around “meme stocks” like GameStop. The phenomenon is attracting a strange brew of not just artists and collectors, but also speculators looking to get rich off the latest fad.

A bubble it may be. But many digital artists, fed up after years of creating content that generates visits and engagement on Big Tech platforms like Facebook and Instagram while getting almost nothing in return, have lunged headlong into the craze. These artists of all kinds—authors, musicians, filmmakers—envision a future in which NFTs transform both their creative process and how the world values art, now that it’s possible to truly “own” and sell digital art for the first time. “You will have so many people from different backgrounds and genres coming in to share their art, connect with people and potentially build a career,” Boykins says. “Artists put so much of their time—and themselves—into their work. To see them compensated on an appropriate scale, it’s really comforting.” Technologists, meanwhile, say NFTs are the latest step toward a long-promised blockchain revolution that could radically transform consumer capitalism, with major implications for everything from home loans to health care.

Read more: TIME releases 3 special edition NFT magazine covers for auction

Digital art has long been undervalued, in large part because it’s so freely available. To help artists create financial value for their work, NFTs add the crucial ingredient of scarcity. For some collectors, if they know the original version of something exists, they’re more likely to crave the “authentic” piece. Scarcity explains why baseball-card collectors, for example, are willing to pay $3.12 million for a piece of cardboard with a picture of Honus Wagner, a legendary Pittsburgh Pirate. It’s also why sneakerheads obsess over the latest limited-edition drops from Nike and Adidas, and why “pharma bro” Martin Shkreli bought the sole copy of Wu-Tang Clan’s Once Upon a Time in Shaolin for $2 million in 2015.

But baseball cards, sneakers and that Wu-Tang CD all exist in the physical space, so it’s easier to understand why they’re worth something. It can be harder to understand why digital art, or any other digital file, has value.

Some digital-art collectors say they’re paying not just for pixels but also for digital artists’ labor–in part, the movement is an effort to economically legitimize an emerging art form. “I want you to go on my collection and be like, ‘Oh, these are all unique things that stand out,'” says Shaylin Wallace, a 22-year-old NFT artist and collector. “The artist put so much work into it–and it was sold for the price that it deserved.” The movement is also taking shape after many of us have spent most of the past year online. If nearly your whole world is virtual, it makes sense to spend money on virtual stuff.

The groundwork for the digital-art boom was laid in 2017 with the launch of CryptoKitties—think digital Beanie Babies. Fans have spent more than $32 million collecting, trading and breeding these images of wide-eyed one-of-a-kind cartoon cats. Video gamers, meanwhile, have been pouring cash into cosmetic upgrades for their avatars—Fortnite players spent an average of $82 on in-game content in 2019—further mainstreaming the idea of spending real-world money on digital goods. At the same time, cryptocurrencies have been booming in value, fueled in part by celebrity enthusiasts like Elon Musk and Mark Cuban. Bitcoin, for instance, is up more than 1,000% over the past year, and anything remotely crypto-adjacent—including NFTs—is getting swept up in that mania.

Sensing an opportunity, tech entrepreneurs and brothers Duncan and Griffin Cock Foster last March launched an NFT art marketplace called Nifty Gateway. At the time, NFT art was just heating up in some circles, but it was difficult for newbies to buy, sell and trade pieces. Nifty Gateway prioritized accessibility and usability, helping fuel wider adoption. “It was such an early stage, we didn’t have many expectations about how it would turn out,” Duncan Cock Foster says. But Nifty Gateway users ended up buying and selling more than $100 million worth of art during its first year. Similar platforms, like SuperRare, OpenSea and MakersPlace, have seen similar surges; they typically pocket 10% to 15% of initial sales.

Big businesses and celebrities are getting in on the action: NBA Top Shot, the National Basketball Association’s official platform to buy and sell NFT-based highlights (packaged like digital trading cards), has racked up over $390 million in sales since its October launch, according to parent company Dapper Labs. Football star Rob Gronkowski has sold NFT trading cards of Super Bowl highlights for over $1.6 million; rock band Kings of Leon made over $2 million by selling NFT music. Twitter founder Jack Dorsey put his first-ever tweet up for auction as an NFT, and it’s expected to sell for at least $2.5 million. The past few months have been a feeding frenzy, with new highs almost daily. Perhaps Beeple put it best after his record-setting auction: “I’m pretty f-cking overwhelmed right now,” he told fans and collaborators gathered on chat app Clubhouse.

So-called whales are making the biggest deals in the NFT art world. These deep-pocketed investors and cryptocurrency evangelists stand to benefit financially from hyping anything remotely related to crypto. “A Winklevoss spending 700 grand on a Beeple or whatever is very much marketing spend for an idea that they are heavily invested in,” the technologist and artist Mat Dryhurst says, referring to Tyler and Cameron Winklevoss, two well-known cryptocurrency bulls who bought Nifty Gateway in late 2019 for an undisclosed amount.

One of those whales is Daniel Maegaard, an Australian crypto trader who made much of what he claims is a $15 million-plus fortune when Bitcoin exploded in value in 2017. Maegaard has bought and sold millions of dollars worth of digital art and other NFT-based goods, like a $1.5 million parcel of land in Axie Infinity, a virtual universe. While Maegaard initially saw NFTs as a means of adding to his wealth, he’s become a true fan of the work, proudly displaying his collection online and excitedly sharing news of new purchases and sales with his followers. He’s particularly attached to a piece called CryptoPunk 8348, an image of a pixelated man who looks vaguely like Breaking Bad’s Walter White. Maegaard, who uses the work as his social media avatar, recently declined a $1 million offer for the piece. “People almost now tie that character to me,” he says. “It’s almost like I’d be selling a part of myself if I ever sold him.”

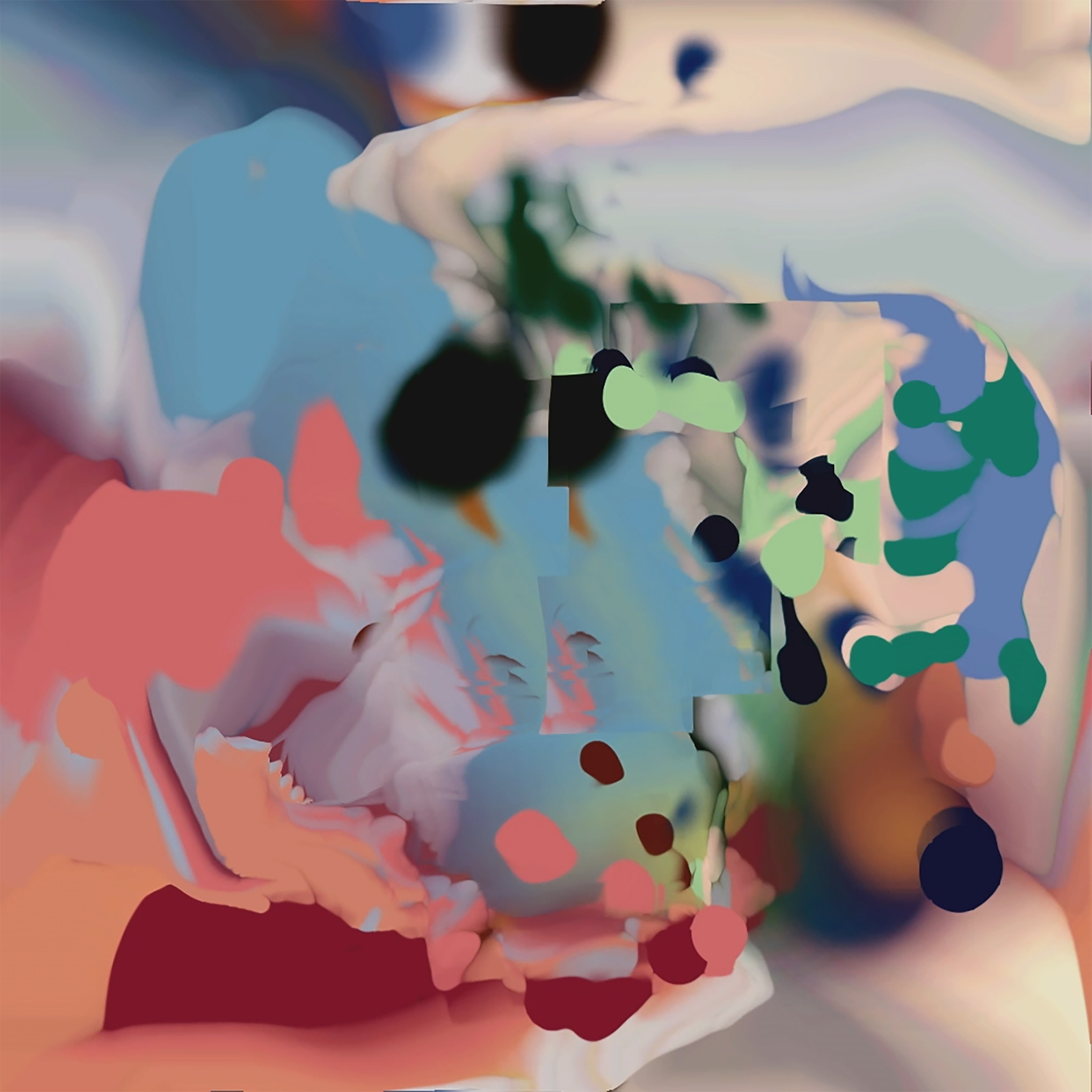

But even investors who see NFT art solely as an asset to be bought low and sold high are putting money into artists’ pockets. Andrew Benson, a Los Angeles-based artist, has been experimenting with psychedelic, glitchy digital video work for years. He’s landed his work in museums and galleries, but he’s long held a day job at a software company and taken on commission work for musicians like M.I.A. and Aphex Twin to support himself. “For a long time, my perspective has been that the best way to survive as an artist is to not have to survive as an artist,” Benson says.

A year and a half ago, when his plans to exhibit a new series of videos fell through, Benson was plagued with doubt about his future in the art world. “I was thinking, Do I even want to go through the trouble of trying to do this kind of work and finding places to show it?” he recalls. Then, in January, a friend who works at an NFT platform called Foundation asked Benson to submit a piece. Benson didn’t think much of it, but sent over a video that otherwise “would have gone on a website or something,” he says. The piece—which looks something like a kinetic, colorful Rorschach—sold within 10 days for $1,250. Since then, Benson has sold 10 more works in the same price range. He’s now pondering a future in which he could sustain himself entirely through his art. “It really kind of shook my worldview, actually,” he says. “Seeing this work find a context and a place where it matters makes me want to think like an artist more.”

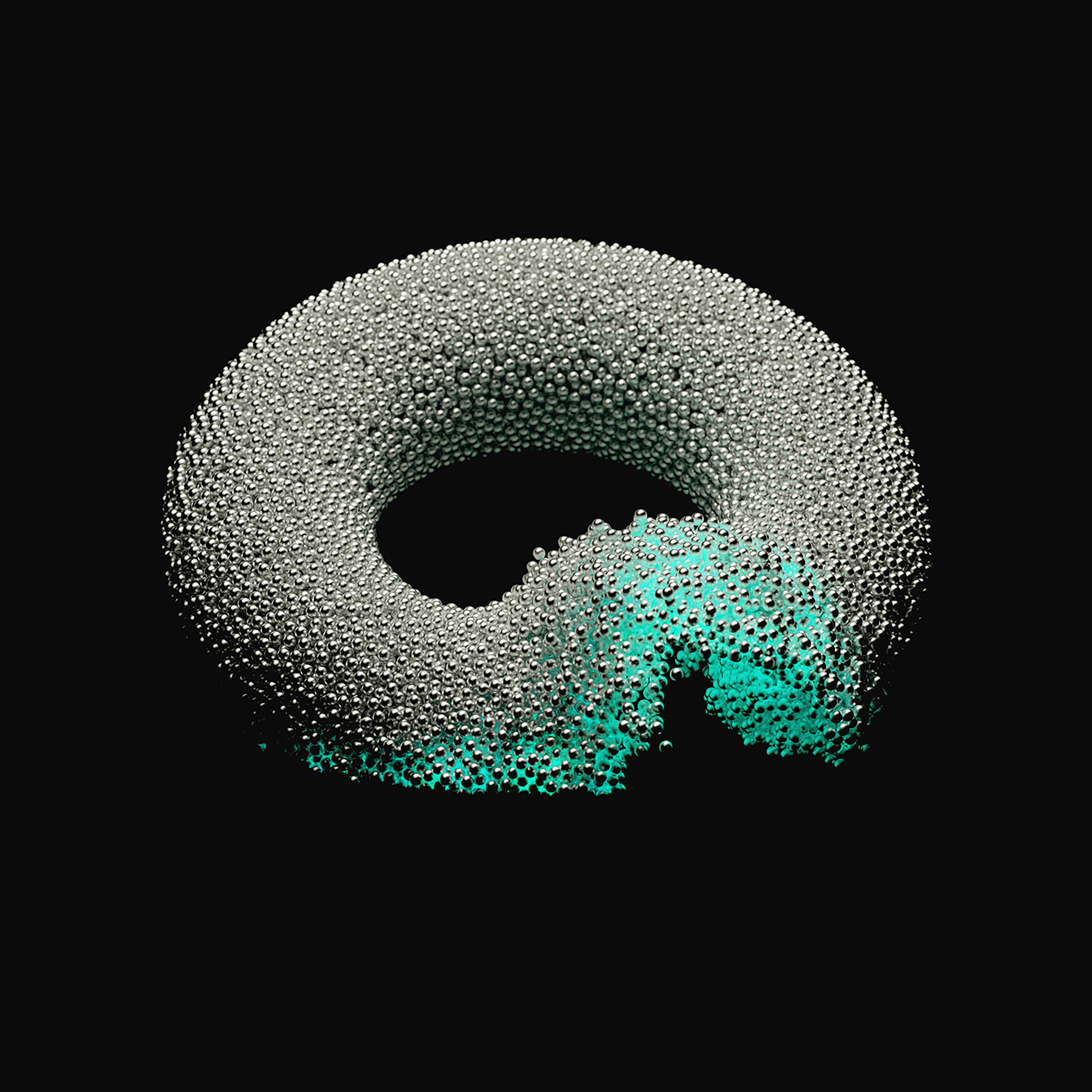

Many other artists working in groundbreaking and sometimes controversial styles are also receiving unprecedented interest from NFT collectors. Art with whirling 3-D renderings, street-style oversaturated color schemes, and hyper-referential (and often crass) cartoons are thriving. These Internet-fueled aesthetics are grabbing the attention of both a younger generation raised on Instagram and a rabble-rousing crypto clientele. “The street art and countercultural styles are being used to reinforce the impression most finance-crypto people have that they are the ‘punks’ in the broader tech and finance world,” Dryhurst says.

These developments have left many in the conventional art world agape. “You have a lot of traditional collectors who look at the NFT space and they can’t plug it into any acceptable system of belief,” says Wendy Cromwell, a New York-based art adviser. “We’re at a real inflection point: a lot of the deeply experienced people in the art world are older and don’t have the interest or mental bandwidth to parse the language of the Internet.” Following Christie’s Beeple sale, however, rival auction house Sotheby’s quickly announced its own partnership with NFT artist Pak, showing that even if art powerhouses might not understand the genre, they understand its financial potential.

With or without the establishment’s support, a new wave of digital artists is banding together in tight-knit NFT communities, echoing past generations of artists across disciplines and genres hanging out and influencing one another’s thinking, approach and output. “There is a huge ethic of generosity happening in the space,” Benson says. “Typically in the worlds of independent music or fine art, there is a sense that one person is going to make it out of a scene. With this, there’s a feeling of abundance where it really does seem like everyone could benefit.”

In some cases, the whales and minnows are swimming in tandem. The buyer of the $69 million Beeple piece turned out to be a collector group called Metapurse, two anonymous Singapore-based investors who have been experimenting with tech-driven collective-ownership models. In January, the duo bought 20 Beeple artworks, placed them in a virtual museum that can be visited for free, and then fractionalized their new enterprise into tokens which are now co-owned by 5,400 people. Their value has since increased sixfold as of March 16. The duo is considering a similar move with their latest headline-grabbing purchase, which they hope to display in a cutting-edge virtual museum. The idea, says Metapurse co-partner Twobadour, is to “open up both the experience of art and its ownership to everybody.”

Even as artists, collectors and speculators benefit from the NFT craze, the phenomenon is not without its dark side. The barriers to entry—it costs money and requires tech savvy to sell an NFT—could prevent some creators from joining in on the action. Many are concerned that young artists of color in particular will be left out, as they have long been marginalized in the “traditional” art world. Legal experts are scrambling to determine how existing copyright laws will interact with this new technology, as some artists have had their work copied and sold as an NFT without their permission. “It’s providing another platform for people to take advantage of other people’s work,” says artist Connor Bell, whose work was plagiarized and posted on an NFT marketplace.

Then there are the environmental concerns. Creating NFTs requires an enormous amount of raw computing power, and many of the server farms where that work happens are powered by fossil fuels. “The environmental impact of blockchain is a huge problem,” says Amy Whitaker, an assistant professor of visual arts administration at New York University, though some cryptocurrency advocates argue these fears are overblown.

Read more: Digital NFT Art Is Booming—But at What Cost?

Theoretically, climate-minded artists could move to some alternative blockchain platform with less environmental impact. They’re already finding ways to bend NFT technology in other beneficial ways. Some, for instance, are setting up their tokens so they’re compensated every time their work is resold, like an actor getting a royalty check when their show airs as a rerun. Taiwanese tech startup Bitmark has started an NFT-like program to give rights and royalties to music producers around the world. And artists who join NFT-based social media sites, like Friends With Benefits, receive fractional ownership in the platform and can receive direct compensation for the work they create through the network, in sharp contrast to existing tech giants like Facebook and Instagram.

For technology evangelists, meanwhile, the NFT frenzy is just more evidence of their long-held beliefs that cryptocurrency, and blockchain platforms more broadly, has the power to change the world in profound ways. Blockchain technology has already been implemented in attempts to make voting more secure in Utah, combat insurance fraud at Nationwide Insurance, and secure the medical data of several U.S. health care companies. Advocates say it could also help companies ensure transparency in their supply chains, streamline mutual aid efforts and reduce biases in historically racist loan-application processes.

“The potential societal impact … is so important that we should do everything in our power to make it manageable, environmentally and otherwise,” Whitaker says. “New idealistic technologies are always really imperfect in their rollout: they can have a speculative boom, and people can misuse them in unsavory ways,” she adds. “I try to stay centered on what’s possible.”

—With reporting by Julia Zorthian

More Must-Reads from TIME

- Cybersecurity Experts Are Sounding the Alarm on DOGE

- Meet the 2025 Women of the Year

- The Harsh Truth About Disability Inclusion

- Why Do More Young Adults Have Cancer?

- Colman Domingo Leads With Radical Love

- How to Get Better at Doing Things Alone

- Michelle Zauner Stares Down the Darkness

Contact us at letters@time.com