Standard Deduction vs. Itemized Deductions: Which Is Better?

Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created by TIME Stamped, under TIME’s direction and produced in accordance with TIME’s editorial guidelines and overseen by TIME’s editorial staff. Learn more about it.

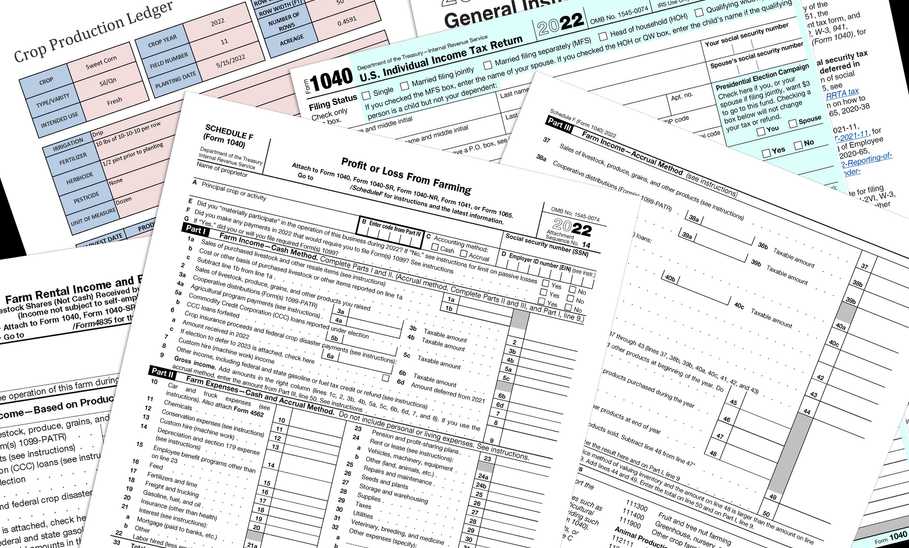

Should you itemize your deductions or take the standard deduction? Both lower how much you pay in taxes, but your lifestyle and expenses determine which option is most beneficial. Compare your potential itemized deductions to the standard deduction and take whichever one nets you the lowest taxable income—and therefore the lowest possible tax bill. Here’s what you need to know about the standard deduction and itemized deductions.

The standard deduction is a specific dollar amount subtracted from your adjusted gross income (AGI) to arrive at your taxable income—which lowers your tax bill. The amount is based on your tax filing status, for example, whether you are married or single. The IRS releases the updated standard deduction amounts prior to the start of the tax year.

For tax year 2024 (tax returns due April 2025), the standard deduction is:

For tax year 2025 (tax returns due April 2026), the standard deduction is:

Claiming the standard deduction is easy. You simply select the dollar amount based on your tax filing status and enter it directly on Line 12 of your Form 1040, U.S. Individual Income Tax Return. However, if you can be claimed as a dependent.) by another taxpayer, your standard deduction is less. You can deduct the greater of:

The Tax Cuts and Jobs Act (TCJA) of 2017 had a major impact on tax filing for U.S. taxpayers. One of the biggest changes was the near doubling of the standard deduction. As a result, more taxpayers than ever are taking the standard deduction rather than itemized deductions. As of the most recent data published by the Internal Revenue Service (IRS), approximately 87% of taxpayers took the standard deduction. Many tax law changes from the TCJA, including the standard deduction changes, are in effect though the end of 2025.

Itemized deductions are specific expenses that you have incurred in allowable categories that can be used to reduce your tax bill. Like the standard deduction, the total of your itemized deductions are subtracted from your AGI to arrive at your taxable income. If the total of your allowable expenses is greater than the standard deduction you qualify for, you should itemize your deductions.

The biggest downside: This is more complicated and time consuming. You also need to document your expenses when you itemize, in case you are ever audited by the IRS.

To claim your itemized deductions, you need to complete Schedule A, Itemized Deductions, of the Form 1040. That total is written on Line 12 of the Form 1040—the same line where the standard deduction would be entered if you opted for it instead.

These are the major categories of itemized deductions:

You should claim the standard deduction if the amount is greater than your potential itemized deductions. With the current tax laws in effect, most taxpayers are better off with the standard deduction. It is easier and requires no calculation or documentation. You simply need to know your filing status.

You should itemize if the total of your allowed deductions are greater than the standard deduction for your filing status. For example, if you own a home, your property taxes and mortgage interest may exceed the standard deduction. If you contribute a significant amount to charity or have large medical expenses in a certain year, it may also benefit you to itemize your deductions.

Which deduction option is best for you is highly dependent on your personal expenses and tax situation. You should compare both options to determine which one allows you the greater deduction—and the lowest tax bill. If the total of your potential itemized deductions is lower than the standard deduction for your tax-filing status, you are better off taking the standard deduction. If the total is higher, you are better off itemizing.

A tax software program, such as TurboTax, can do this comparison for you. It asks a series of questions to identify which itemized deductions you qualify for. From there, you just need to enter the dollar amount you have paid for each expense type. If you want even more assistance, there are other options:

Here are four types of deductions that you may see on your paycheck:

Generally, if your earned income is less than the standard deduction, you will not have to file a tax return. But always double check—there are certain situations where you may still be required to file a tax return.

There is currently no limit on the total of your itemized deductions—but there are limits on how much you can deduct from certain categories. For example, state and local taxes have a limit of $10,000 (or $5,000 if married filing jointly).

Before 2017, the 2% floor rule limited itemizing miscellaneous expenses. Taxpayers could only claim miscellaneous expenses that exceeded 2% of their AGI. With the tax changes from the TCJA, these deductions have been suspended, along with the 2% rule that limited them. This means the 2% rule does not apply at least through 2025. Miscellaneous expenses included:

The information presented here is created by TIME Stamped and overseen by TIME editorial staff. To learn more, see our About Us page.