Small Cap Stocks: All You Need to Know

Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created by TIME Stamped, under TIME’s direction and produced in accordance with TIME’s editorial guidelines and overseen by TIME’s editorial staff. Learn more about it.

Some of the best investments started out as small-cap stocks—those with a market capitalization between about $250 million and $2 billion. Of course, not every small-cap company grows into a behemoth like Amazon or Apple (which recently became the world's first company to reach $3 trillion in market cap). Still, investing in small companies can be rewarding, especially because they offer greater upside growth potential than larger companies.

If you're looking for the best stock investments and considering small-cap stocks, here's an explainer to get you started.

Market capitalization—or market cap—measures a company's size. It's the total value of a company's outstanding stock shares, including publicly traded shares and restricted shares held by company officers and insiders. To calculate market cap, multiply the company's number of shares outstanding by its current share price. For example, a company with 10 million shares outstanding and trading at $20 will have a market cap of $200 million.

Market cap matters because it provides clues about where a company stands in the business development process. For example, relatively new public companies with smaller market caps may have more room for growth. Market cap also gives a rough indication of a company's stability: Large-cap companies typically are less vulnerable to volatility than mid or small-cap companies.

According to FINRA (the Financial Industry Regulatory Authority), the delineation between market cap sizes varies, but you'll generally see them broken down like this:

| Company size | Market value |

|---|---|

Mega-cap | $200 billion or more |

Large-cap | $10 billion to $200 billion |

Mid-cap | $2 billion to $10 billion |

Small-cap | $250 million to $2 billion |

Micro-cap | Less than $250 million |

With market caps of $10 billion or more, large-cap companies are mature, well-known companies that are key players in their industries. While their days of aggressive growth may be behind them, large-caps typically offer stability, and many pay consistent dividends. Meanwhile, small-caps have historically outperformed their larger counterparts and are more likely to experience rapid revenue and profit growth. However, that potential growth comes at a price: small-cap share prices tend to be more volatile and sensitive to macroeconomic shifts, which can be unsettling to risk-averse investors.

Mid-caps tend to be established companies in industries experiencing (or expected to experience) significant growth. With market caps between $2 billion and $10 billion, mid-caps offer less volatility and risk than small-caps—and greater growth potential than large-caps. For this reason, mid-cap stocks can be a good option for investors looking for a balance: moderate growth potential combined with moderate risk.

Penny stocks have low share prices (under $5) and usually trade over the counter (OTC) via pink sheets instead of on an exchange like most stocks. Because penny stocks have low market caps, they technically fall under the umbrella of small-cap stocks—or micro-caps, to be more specific.

However, penny stocks are far riskier investments because they lack liquidity, have a wide bid-ask spread, and represent a stake in an unprofitable company. Furthermore, some penny stocks are scams, such as pump and dump schemes, where scammers spread false or misleading information to "pump" up prices and then "dump" their shares at an artificially inflated price.

Your risk tolerance and investment goals influence how much cash you should allocate to small-cap stocks versus other types of investments. Here are suggested allocation breakdowns by risk tolerance from the American Association of Individual Investors (AAII):

| Investment category | Aggressive investors | Moderate investors | Conservative investors |

|---|---|---|---|

Large-cap stocks | 20% | 20% | 20% |

Mid-cap stocks | 20% | 15% | 10% |

Small-cap stocks | 20% | 10% | 0% |

International stocks | 20% | 15% | 10% |

Emerging market stocks | 10% | 0% | 0% |

Intermediate bonds | 10% | 30% | 40% |

Short-term bonds | 0% | 10% | 20% |

Small-cap stocks offer high growth potential, but it's wise to consider the pros and cons before making decisions.

Pros

Cons

If you decide investing in small-cap stocks is right for you, you can buy and sell shares of individual companies directly through an online broker, such as TradeStation. If buying individual stocks seems too risky or time-consuming, you can invest in small-cap focused exchange-traded funds (ETFs) and mutual funds, such as iShares Russell 2000 ETF (IWM), Fidelity Small Cap Growth Fund (FCPGX), or Vanguard Small-Cap Value Index ETF (VBR).

Keep in mind that less analyst research is available for small-cap stocks versus their larger counterparts. If you don't have the time, interest, or expertise to make your own trading decisions, consider working with a financial advisor which you can find through services like WiserAdvisor, or a robo-advisor such as M1 Finance.

Two main indexes are used as benchmarks for the small-cap equities market:

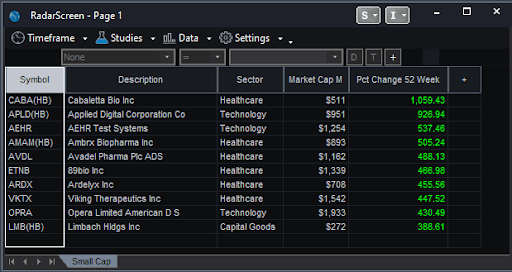

To find the best small-cap stocks by one-year performance, we used TradeStation's Radar Screen to search the universe of U.S. stocks with market caps between $250 million and $2 billion. We then sorted the results by percent change over 52 weeks to find the top 10:

A TradeStation Radar Screen showing the top 10 small-cap companies based on one-year performance. Courtesy PowerZone Trading. (Note: TradeStation includes "HB" following a symbol to designate hard-to-borrow stocks for short sale purposes; the extension is not part of the symbol name.)

Small-cap stocks offer significant growth potential—something large-cap companies can't because their days of aggressive growth are generally behind them. However, the higher the potential reward, the higher the risk. While most investors would love to get in early on the next Amazon or Google, small-cap stocks are riskier than mid- and large-cap stocks because the companies are less established, have shorter track records, and potentially have less access to capital, making share prices more volatile. Small-cap stocks are best suited for investors comfortable with the added risk in exchange for higher potential rewards.

As with any investment, it's essential to do your research before picking individual stocks or funds for your portfolio. If you don't have the time, interest, or expertise to choose investments, consider working with a financial advisor or robo-advisor.

According to research from Schroders, small-cap stocks saw a 9.9% annualized net total return during "recession and recovery" periods over a nearly 40-year period that included numerous recessions, including the global downturn of 2007/2008. Large-cap stocks saw average returns of 4.9% over the same period. Of course, remember that past performance doesn't guarantee future results.

According to T. Rowe Price, smaller companies may prove more resilient than many expect during periods of high inflation and rising rates. History shows that U.S. small-cap companies tend to outperform their larger counterparts when inflation and interest rates rise. Furthermore, small-caps have generally led the market recovery following a recession, often outperforming larger companies over multiple years.

Some experts say small caps may do better than large caps during inflationary environments because it's easier for them to pivot and make changes, such as quickly raising prices or finding new sources for goods and materials.

For the year-to-date period ending Aug. 18, 2023, the Russell 2000 (which tracks the 2000 smallest companies in the Russell 3000 Index) increased 6.21%. Meanwhile, the Russell 1000—a subset of the Russell 3000 representing the 1000 top U.S. companies by market cap—was up 14.10%. And the Russell Top 50, which includes the 50 largest stocks in the Russell 3000 universe, rose 25.62%.

According to Royce Investment Partners, a small-cap specialist, the year began with an advantage for small-cap stocks, but that edge only lasted until early February. However, it says small-cap performance could see a boost in the coming months as a recession looks less and less likely.

The information presented here is created by TIME Stamped and overseen by TIME editorial staff. To learn more, see our About Us page.